nj tax clearance certificate dissolution

Dissolving by Shareholder Vote. The filing fee for LLCs is 100.

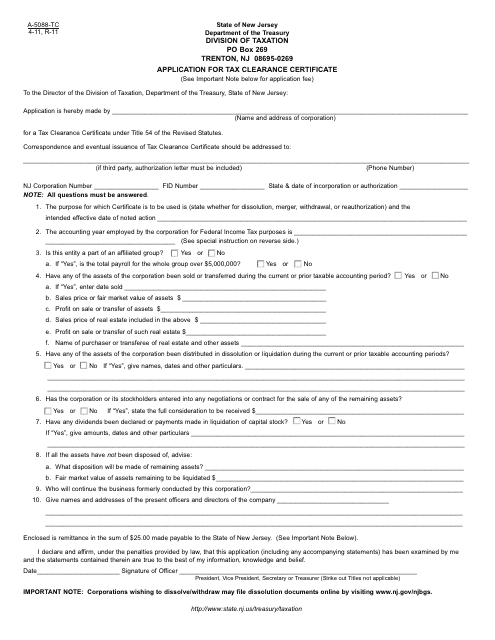

Form A 5033 Tc Procedure For Dissolution Withdrawal Surrender Or Reauthorization

To effect such a dissolution all shareholdersmembers shall sign and file in the Office of the Treasurer Division of Revenue the following articles of dissolution.

. This requires that your LLC be in good standing with the New Jersey. After casting their vote in favor of the dissolution the legal process must be started. If you have any questions concerning tax clearance or other tax issues call the Division of Taxation at 6092926400.

Contact Spiegel Utrera PA. New Jersey requires several steps to dissolve an LLC. A certificate of dissolution NJ may be sought by a company looking to dissolve itself.

When you dissolve your company in the. View information on the consequences of not dissolving. How to Dissolve an LLC.

Signature of the Chairman of the Board President or Vice President. You will also need to include Form A-5088-TC Application for Tax Clearance Certificate and Form A-5052. A New Jersey corporation has to pay a 120 filing fee which includes 95 for the dissolution filing and 25 for the tax.

First the corporation must pay 120 of which 95 is a dissolution fee and 25 is a tax clearance certificate application fee. 6 Second the corporation must submit a Form A-5088-TC. A dissolution shall be considered filed and effective as of the date the Division of Revenue receives the properly.

First of all you must obtain a tax clearance certificate. Download or print the 2021 New Jersey Form A-5033-TC Procedure for Dissolution Withdrawal Surrender or Reauthorization for FREE from the New Jersey Division of Revenue. When the Corporate Dissolution is Effective in NJ.

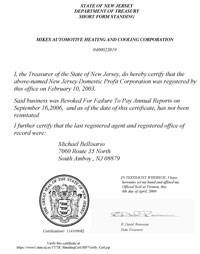

Walk-in filings have to pay another 25. After July 1 2017. The Tax Clearance Certificate is evidence that the requisite corporation.

Monthly Late Filing Penalty 100 per month Amnesty Penalty of 5 for certain years. You may be responsible for annual reports and fees in each state for the year in which you dissolved your LLC. For a free consultation and guidance through.

The Tax Clearance Certificate is dated and it voids and becomes a nullity 46 days after that date. Here are the steps to address for dissolving New Jersey LLC. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation.

Interest is computed at 3 above prime rate compounded annually.

Nj Corporation Dissolution How To File Paperwork

Dissolve Your New Jersey Business Today Zenbusiness Inc

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

Tax Clearance Certificates Department Of Taxation

C 159b Certificate Of Dissolution Dissolution Pdf4pro

Incorporate In New Jersey Today Starts At 49 Zenbusiness Inc

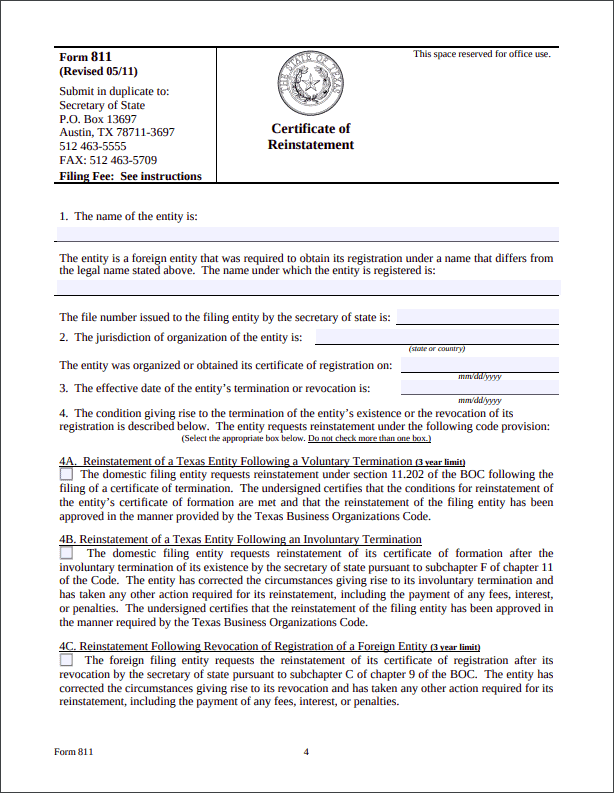

Free Guide To Reinstate Or Revive A Texas Limited Liability Company

How To Get A Tax Clearance Certificate 50 State Guide Nolo

Application For Tax Clearance New Jersey Edit Fill Sign Online Handypdf

Nj A 5088 Tc 2011 2022 Fill Out Tax Template Online

Nj Taxes Registering Filing Paying Beach Haven 7 Beach Haven Vacation Rental Lbi

How To Dissolve An Llc In New Jersey Llc Closing Guide

Application For Tax Clearance New Jersey Free Download

New Jersey Business Reinstatement And Dissolution Program

New Jersey Good Standing Certificate Nj Certificate Of Existence

Fillable Online State Nj Certificate Of Dissolution Form C 159 B Fax Email Print Pdffiller

Form A 5088 Tc Application For Tax Clearance And Instructions

Failing To Legally Close Your New Jersey Business Can Lead To Liability

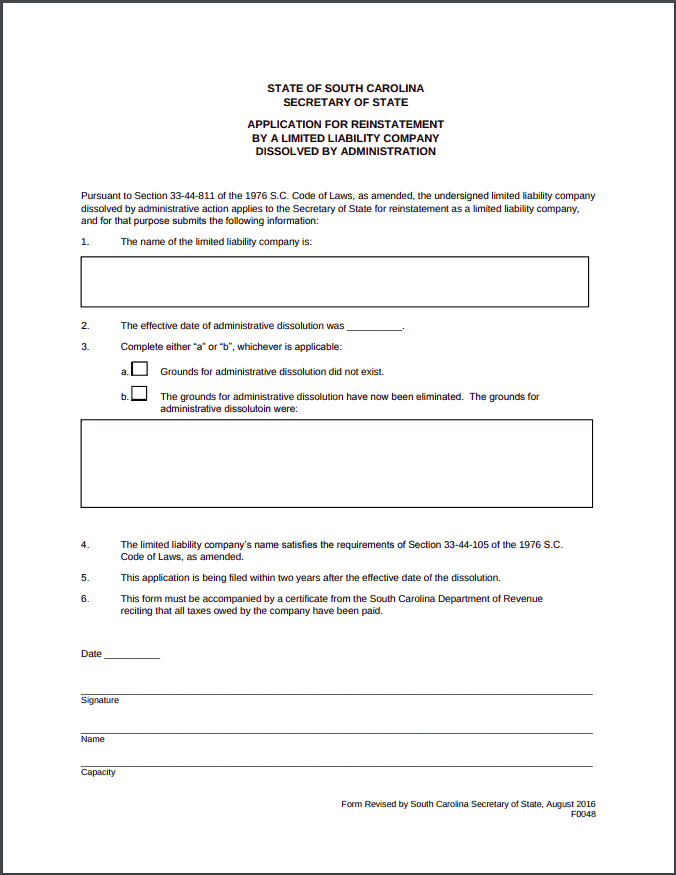

Free Guide To Reinstate Or Revive A South Carolina Limited Liability Company